Expatica News

A group of real estate developers and property owners in La Manga del Mar Menor - a spit of sandy, low-lying coastal land and Murcia’s premier beach resort - are threatening to take Greenpeace to court over its graphic predictions of what global warming may do to the area, which they say have caused house prices to plummet. The lawsuit, which the plaintiffs plan to present unless Greenpeace agrees to an out of court settlement of almost EUR 30 million in damages, comes more than six months after La Manga featured prominently in a photo book published by the environmental organisation that was intended to shock Spain into action on climate change.

Along with photos of a dried up Ebro River in Zaragoza and a desert in an area of Valencia now filled with lemon and orange groves, the book, Photoclima, shows digitally modified photos of La Manga submerged in water with only the tops of hotels, apartment blocks and palm trees emerging from the blue Mediterranean. Greenpeace says the book is a graphic portrayal of the conclusions of the UN Intergovernmental Panel on Climate Change, which has predicted that global warming will cause sea levels to rise around the world over the coming decades.

“We want to create alarm and a call to action,” Juan Lopez de Uralde, Greenpeace’s director in Spain, said when the book was published. The photographs certainly caused alarm in La Manga. According to Jose Angel Abad, a lawyer who has taken up the case of the area’s aggrieved developers and home owners, prices have plunged by “50 percent” in recent months - a dramatic fall even in light of the end of a nationwide house price boom.

“Greenpeace manipulated the expected rise in sea levels of half a metre to cause alarm. It has sunk the real estate market: no one is buying and everyone has put their apartments up for sale,” Abad claims. Read more here.

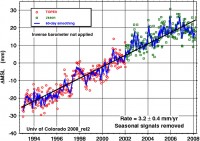

Icecap note: Let’s hope this is the first of many suits against alarmists and irresponsible environmental groups. The La Manga group has a case. Note that sea levels are not accelerating up but appear to be falling in part due to ocean cooling and compression and perhaps part due to record extent of Antarctic ice. Certainly there is no signs of an alarming increase threatening coastal areas as Gore and Hansen have prophecized.

Sea level changes since 1994 from TOPEX and Jason satellites. See larger image here

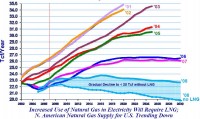

US Department of Energy NETL Report Summary on SPPI

In an April 2008 white paper entitled, “Natural Gas and Electricity Costs and Impacts on Industry”, the U.S. Department of Energy’s National Energy Technology Laboratory (NETL) reported that opposition to new coal-based power plants is leading to a generation capacity shortage in many areas of the country and endangering U.S. energy security. The opposition is also inducing a “dash to gas” and quickly causing a rise in natural gas prices at a time when federal climate change legislation could immediately lead to a doubling of natural gas consumption for power generation. This legislation would increase the country’s dependence on foreign energy sources in the form of liquefied natural gas (LNG) causing both natural gas and electricity prices to increase dramatically.

NETL also describes how coal has protected consumers from even higher natural gas prices. Unfortunately, the current opposition to coal would allow natural gas prices to match the percentage increase in the price of oil. Such increases in the price of natural gas could cause trade-exposed sectors of U.S. industry to shut in production, especially against coal-powered competitors like China or regions like the Middle East, where cheap natural gas reserves supply power needs. NETL estimates, by 2016, the absence of 18 GW of currently forecasted new coal-based power plants would mean additional natural gas demand of 1.4 Tcf/year, or almost all of the presently forecasted LNG growth. If electricity growth were higher, as it is in U.S. Energy Information Administration’s latest Annual Energy Outlook (AEO), up to an additional 2.3 Tcf of natural gas for generation would be

needed. In the event of climate change legislation with relatively strict cap and trade provisions, such as S.2191 – the Lieberman-Warner Climate Security Act, an additional 5.4 Tcf/year is required for even more coal-to-gas switching, and even more natural gas generating capacity would be necessary just to meet peak demand. Since this approximate 9 Tcf increase in natural gas consumption would be occurring at high prices, the impact on the economy would be severe. Because both electric rates and heating prices would

escalate, no sector would be exempt; although families and energy-intensive industry would certainly bear the heaviest burdens.

See larger image here

For more of this one page summery go here. For full NETL Report go here.

By Timothy Gardner, Reuters

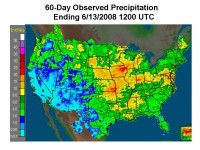

Floods in the Midwest that have pushed corn prices to record levels have wiped out profits for making U.S. ethanol and threaten to sink production of the fuel below government mandates. “If it’s simply economically impossible to make ethanol. then (the government) may have to amend or suspend the Renewable Fuel Standard,” analyst Pavel Molchanov at Raymond James and Associates in Houston said by telephone. The floods ravaging the corn crop across at least eight states, including Iowa and Illinois, at a time of growing global demand have put another roadblock before the U.S. biofuels policy. Hoping to wean the country off foreign oil, the Bush administration has boosted incentives and mandates for alternative fuels made from food crops. Many have blamed those steps for lifting food prices at a time of mounting hunger problems.

Corn prices for the new-crop July 2009 corn hit a record near $8 per bushel on Friday, while old-crop also hit a record above $7. Molchanov estimated that average U.S. producers now lose 8 cents for every gallon of ethanol distilled, compared with a profit margin of 20 cents a gallon two weeks ago. Besides higher corn prices, margins also have been squeezed by two-year highs for natural gas, which fires most ethanol plants. As much as 2 billion to 5 billion gallons of ethanol “could go offline in the next few months due to high corn prices,” a Citi Investment Research note said. U.S. ethanol production capacity is about 8.8 billion gallons per year from 154 distilleries. “If the ethanol is not there, I don’t think the government expects blenders to blend as much,” said Ron Oster, an analyst at BroadPoint Capital in St. Louis. Read more here.

See 60 day US rainfall above and in larger image here

See larger image of Corn Belt states (with average % of production) here