"We would never propose a carbon tax”—White House spokesman

E&E News reports: “If President Obama left any doubt during his news conference yesterday about whether he would push a new carbon tax to fight climate change, White House spokesman Jay Carney tried today to put the issue to bed. ‘We would never propose a carbon tax and have no intention of proposing one,’ Carney said, according to a White House transcript of a press briefing on board Air Force One. It was an unusually blunt assessment of a policy position the White House had been telegraphing even before Obama’s speech. Carney acknowledged that Obama believes there’s more work to do to fight climate change but said the president’s immediate focus would be economic and job growth. “Task No. 1 is dealing with these [fiscal cliff] deadlines that pose real challenges to our economy,’ Carney said.”

“House GOP Opposes Carbon Tax”

Inside EPA reports: “The entire House GOP leadership has signed a free-market group’s pledge to oppose a carbon tax in the 113th Congress, which could further undermine environmentalists and others as they push for the tax, after the White House signaled it has no intent to propose such a measure even in the midst of a fiscal crisis. Pro-carbon tax groups continue to press for the policy as one that could reduce emissions and raise much-needed revenues. For example, the groups Green for All and Rebuild the Dream issued a Nov. 15 statement noting, ‘President Obama indicated that he’s committed to fighting climate change while creating jobs. A carbon tax could achieve both. It would help end the fiscal standoff and save important federal programs without burdening low-income and middle-class families.’ However, Obama at a Nov. 14 press conference said he will likely delay further policy action on climate change until after ‘wide ranging’ talks with experts—a statement that coupled with the House GOP anti-carbon tax pledge suggests dim prospects for the measure.”

“House GOP leaders pledge to oppose climate change ‘tax’”

The Hill reports: “The entire House GOP leadership team has registered its opposition to climate legislation that raises revenue, underscoring the long odds that taxing carbon emissions has in negotiations on the fiscal cliff. The Tea Party group Americans for Prosperity greeted Wednesday’s election of the House GOP leadership team by pointing out that the lawmakers are among the signers of the group’s ‘no climate tax’ pledge. Signers agree to ‘oppose any legislation relating to climate change that includes a net increase in government revenue.’ They include Speaker John Boehner (R-Ohio), Majority Leader Eric Cantor (R-Va.) and Whip Kevin McCarthy (R-Calif.), who all retained their leadership posts.”

The Green agenda and carbon taxes have decimated Europe. The greens don’t care. Spain’s Unemployment is 25.8%, Greece 25.4%, Macedonia 31.6%. Spain invested heavily in wind and solar subsidies which sent energy prices skyrocketing and industry overseas. They have stopped the subsidies. Because these socialist governments have entitlement societies, forced cutbacks lead to riots. That is our future if our government gives into pressure from environmental terrorists.

----------

Five GOP Bills Obama Should Support

Convinced that he has a mandate to increase taxes in his second term, President Barack Obama is reportedly planning to “barnstorm” the country in January if House Republicans fail to accept his demands.

But before Obama bills taxpayers for his transcontinental victory lap, he would be wise to rethink his opposition to five House-passed regulatory reform measures currently languishing in the Democrat-controlled Senate.

Because increases in regulation decrease profit by shifting resources toward compliance rather than growth, new regulations have the same effect as new taxes. If Obama is looking for a way to build credibility on a tax reform deal with House Republicans, he would be wise to persuade his fellow Democrats to pass these House-backed regulatory reforms.

1. Regulations from the Executive In Need of Scrutiny (REINS) Act

Since the regulatory spree inaugurated by the New Deal, Congress has been complicit in the enormous increase in federal regulations. Every year these rules further constrict the ability of the private sector to create jobs and grow the economy. The game goes like this. Congress passes a vague law empowering an agency to regulate an entire industry or activity. The agency writes rules and implements them, at huge costs to consumers and producers. Congress is outraged, but does little to stem the tide.

In 2010 alone, federal agencies implemented 100 “major rules,” meaning each rule is expected to have an economic effect of $100 million or more annually. Congress has very little power to stop such regulations from going into effect, and no incentive to tinker with them once the market absorbs them. The REINS Act corrects this problem by requiring any major rule to be approved by both houses of Congress before it becomes law.

2. Regulatory Accountability Act

Where the REINS Act targets the impact of major rules, the Regulatory Accountability Act (RAA) reforms the way rules are made. Currently, agencies under a president’s control are required by executive order to use cost-benefit analysis when evaluating the impact of their proposed regulations. But executive orders can be rescinded by any president at any time. Under RAA, the cost-benefit requirement becomes legally required no matter which president is in office.

RAA also extends the cost-benefit rule to independent agencies, so called because technically they are not under the direction of a president when making policy decisions. Examples include the National Labor Relations Board and the Federal Communications Commission. Under Obama, both the NLRB (in rulings against right-to-work states) and the FCC (with its misnamed Net Neutrality policy) have proposed sweeping regulatory changes without bothering to consider how much their dictates will cost. It’s time for every agency in the federal bureaucracy to calculate the burden of its regulations.

3. Red Tape Reduction and Small Business Job Creation Act

One of the biggest complaints from the private sector is that the barrage of costly new rules spewing out of Washington makes it almost impossible to justify expanding staff levels or capital improvements. Faced with a string of unfunded mandates from laws like Obamacare and others, small businesses are wisely opting to stockpile money and outsource jobs, rather than risk hiring full-time workers who are too expensive to employ.

If it became law, this bill would prohibit any new economically significant regulation from going into effect unless the unemployment rate falls to 6 percent or below. It would also remind bureaucratic administrators of the link between regulation and the job market.

4. Reducing Regulatory Burdens Act

Speaking of the job market…

This bill easily could be called the Pesticide Industry Relief Act, but the official name is more attractive and just as accurate. In 2006, a federal appeals court threw out the Bush EPA’s decision not to require crop dusters and other pesticide sprayers to obtain a permit under the Clean Water Act (CWA).

The Bush EPA had three good reasons opposing yet another permit process. First, pesticide regulation is covered under the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA), not CWA. Second, pesticides already go through a rigorous screening process under FIFRA, so users know the relevant guidelines. Third, the extra compliance costs would be oppressive. By its own count, EPA estimates that the new permit gauntlet will add 1,033,713 hours of work for permit-seekers, as well as 45,809 hours of work for officials to process them.

Because of all this, it is no wonder the Reducing Regulatory Burdens Act was passed unanimously by Republicans and Democrats out of committee, and with all Republicans and 57 Democrats voting to send it to the Senate. Getting this bill signed into law would mark at least one occasion where Obama took seriously complaints about onerous and duplicative compliance costs.

5. Regulatory Flexibility Improvements Act

Of the bills mentioned thus far, this may be the least likely to inspire a regulatory reversal by President Obama since he has already threatened a veto if it ever comes to his desk.

Still, the measure has merit. If passed, the Regulatory Flexibility Improvements Act would draw bureaucrats’ attention to the impact of new regulations on small businesses, meaning those entities without recourse to lobbyists, lawyers and other liaisons to soften the blow rules have on the bottom line. RFIA would increase the quantitative data available on how a proposed regulation could harm or benefit small businesses by requiring agency officials to post their findings on the agency’s website.

When he entered office, Obama promised to preside over “the most transparent administration in history.” Changing his tune on RFIA would be a big step in that direction.

Signing any of these reforms into law would help build toward the kind of bipartisan consensus Republicans and Democrats will need to make any real progress on a tax reform deal, but the clock is ticking.

When the new Congress is sworn-in in January the legislative system resets, and all of the bills that failed to get to the president will die.

In order to get the nation’s economy moving in the right direction, House Republicans and the Obama White House should make the latter’s campaign slogan their own: “We Can’t Wait.”

President Barack Obama got the facts wrong on global temperatures in his brief discussion of climate change Wednesday afternoon, according to Joe Bastardi, a meteorologist and Chief Forecaster to Weatherbell Analytics.

In his first press conference since March, Obama addressed one question on climate change from Mark Landler of the New York Times, premised on recent claims from climate change activists that Hurricane Sandy was evidence of global warming.

Obama’s answer was also a mere regurgitation of the same incorrect claims from climate change activists, says Bastardi, and did not necessarily represent entirely accurate facts. Below is Landler’s question, followed by an excerpt of the president’s answer.

Q: Thank you, Mr. President. In his endorsement of you a few weeks ago, Mayor Bloomberg said he was motivated by the belief that you would do more to confront the threat of climate change than your opponent. Tomorrow you’re going up to New York City, where you’re going to, I assume, see people who are still suffering the effects of Hurricane Sandy, which many people say is further evidence of how a warming globe is changing our weather. What specifically do you plan to do in a second term to tackle the issue of climate change? And do you think the political will exists in Washington to pass legislation that could include some kind of a tax on carbon?

PRESIDENT OBAMA: You know, as you know, Mark (sp), we can’t attribute any particular weather event to climate change. What we do know is the temperature around the globe is increasing faster than was predicted even 10 years ago. We do know that the Arctic ice cap is melting faster than was predicted even five years ago. We do know that there have been extraordinarily - there have been an extraordinarily large number of severe weather events here in North America, but also around the globe.

Earlier Wednesday, Breitbart News published a response from Bastardi to similar claims recently published by the Huffington Post. Upon hearing the president’s statement today on the matter, he provided the following response to Breitbart News.

First, I would like to point out that it is refreshing to see the President discard some of the hysteria surrounding Hurricane Sandy and its link to global warming. Anthropogenic global warming activists will attribute every extreme weather event to global warming, which has now been termed “climate change” since the earth has stopped warming, which leads us to the next issue with the President’s comments.

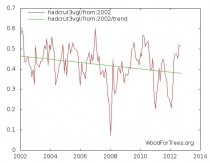

Not only are temperatures not increasing faster than was predicted ten years ago, temperatures have not increased at all since the late 1990’s.

Click to enlarge.

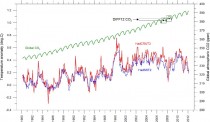

Furthermore, when you compare the observed temperatures of the past 10 years against all the climate model predictions, the result should do more than raise eyebrows about how much tax-payer money is being wasted on climate science that is proving to be wrong.

Click to enlarge.

Before we make carbon policy that can hurt our already struggling economy, there needs to be an unbiased debate about what is actually driving our climate.

As stated earlier today at Breitbart News, it will be that much more important that hyperbole and political agenda do not drown out facts and historical reality as the process of reconstructing homes and lives in the wake of Sandy takes place.

Read the full transcript of President Obama’s news conference today, including the complete Question and Answer portion.

-----------

STEVE GODDARD OF REAL SCIENCE ADDS:

Temperatures have declined over the last 10 years, and the US is experiencing the longest period without a major hurricane strike in 150 years. This past summer had the fewest tornadoes on record. Obama apparently believes that whatever stupid ideas pop up in his head must be true.

Joanne Nova

June 2011.

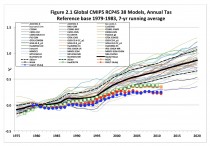

Yet another study hunted for a form of the missing hot spot– and again the results show the models are unable to make useful predictions.

The upward rising trend predicted in the models is of critical importance. The models assume that the 1.1 degrees of warming directly due to CO2 will be tripled by feedbacks from humidity and water vapor. Studies like Fu and Manabe are looking to see if the assumptions built into the models are right. If relative humidity stays constant above the tropics throughout the troposphere, we should see the upper troposphere warm faster than the surface.

Fu and Manabe used satellite data rather than weather balloons, and compared the tropical upper troposphere to the lower middle troposphere during 1979 – 2010. (Other papers I’ve written about compared the upper troposphere to the surface, and mainly used weather balloons.)

“One of the striking features in GCM‐predicted climate change due to the increase of greenhouse gases is the much enhanced warming in the tropical upper troposphere”

Satellites cannot separate out the altitudes at narrow resolutions, as the radiosondes can, but they produce reliable data around the entire globe. In this test of the models predictive ability, we should have seen the upper troposphere warm faster than we did. Indeed while the difference in trends was positive, it was so weakly positive as to be not significantly different. In other words, we can’t be sure that the upper troposphere is warming faster than the lower-middle area, though it might be. Even if it is warming, it just isn’t doing it enough to verify the models.

Given that the IPCC don’t seem to be in a rush to acknowledge the discrepancies between models and observations (heck, they were discovered by the mid-90′s), this is what “90% likely to be right” looks like:

36 different models are compared with satellite data. Reality is seemingly not what the models thought it ought to be.

The trends of T24‐T2LT from both observations and models are all positive (Figure 2, below), indicating that the tropical upper‐middle troposphere is warming faster than lower middle troposphere [Fu and Johanson, 2005]. But the positive trends are only about 0.014 +/- 0.017 K/decade from RSS and 0.005 +/- 0.016 K/decade from UAH, which are not significantly different from zero. In contrast, the T24‐T2LT trend from multi‐model ensemble mean is 0.051 +/- 0.007 K/decade, which is significantly larger than zero. The trends from observations and multi‐model ensemble mean do not fall within each other’s 95% confidence intervals…

Enlarged

The black line is the model prediction but the red and blue lines are the RSS and UAH trend lines.

Maybe the satellites are wrong and not the models:

This indicates possible common errors among GCMs although we cannot exclude the possibility that the discrepancy between models and observations is partly caused by biases in satellite data.

But remember that 28 million radiosondes have found similar discrepancies with the models in the tropical upper troposphere. If millions of radiosondes and 30 years of satellite data are both biased, then the models could be right.

Conclusion:

IPCC AR4 GCMs overestimate the warming in the tropics for 1979–2010, which is partly responsible for the larger T24‐T2LT trends in GCMs. It is found that the discrepancy between model and observations is also caused by

the trend ratio of T24 to T2LT, which is ∼1.2 from models but ∼1.1 from observations. While strong observational evidence indicates that tropical deep‐layer troposphere warms faster than surface, [note we don’t name any...] this study suggests that the AR4 GCMs may exaggerate the increase in static stability between tropical middle and upper troposphere in the last three decades. In view of the importance of the enhanced tropical upper tropospheric warming to the climate sensitivity and to the change of atmospheric circulations, it is critically important to understand the causes responsible for the discrepancy between the models and observations.

——————————————–

Extra information:

The post that will put this in perspective best is The models are wrong (but only by 400 %). (McKitrick et al 2010)

The missing hotspot (What they expected to find, and what the weatherballoons didn’t show)

Even gurus of warming admit the hot spot went missing.

For other perspectives:

Roger Pielke discussed this in July, as did Jeff ID on the air vent a few weeks ago.

REFERENCE

Fu, Q., S. Manabe, and C. Johanson (2011), On the warming in the tropical upper troposphere: Models versus observations, Geophys. Res. Lett., 38, L15704, doi:10.1029/2011GL048101. [PDF]